Services & Fee Structure

Our Fee Structure

Because they can!

Tuyyo Planning Group does not want to participate in the “bait and switch,” too-complicated-to-explain, hidden agenda industry! Consumers today demand to know that what they pay for and what it costs. We believe in full transparency.

Reduction of Conflicts of Interest

While it is virtually impossible to avoid all conflicts of interest, we believe a flat fee, rather than an asset based fee, fosters advice better suited for clients accumulating wealth. When clients are accumulating wealth, they have different financial considerations to those of clients nearing (or in) retirement.

- Should we pay off the mortgage sooner?

- Should we roll over our old 401-K into our new employer 401-K or an IRA?

- Should we invest in our business or retirement accounts?

- Should we pay extra towards our student loans?

Questions like these create a conflict of interest for advisors under an asset based fee model because they are paid a percentage of the assets they manage or take under management. Giving advice to the above questions may negatively impact the amount the advisor manages and therefore gets paid. We believe this conflict should be eliminated in your accumulating years so you can feel confident our advice is always in your best interest.

Flat Fee vs Traditional Asset-Based Fee

The amount of work involved for an advisor managing a $150,000 portfolio vs a $500,000 portfolio is about the same if the client is in their accumulating years and agrees with our investment philosophy. We believe when you are accumulating wealth, the complexity for the advisor to manage your nest egg is very different than when you are needing to generate income from it in retirement. The example below illustrates the potential long term costs in a flat fee structure vs. a traditional asset-based fee structure.

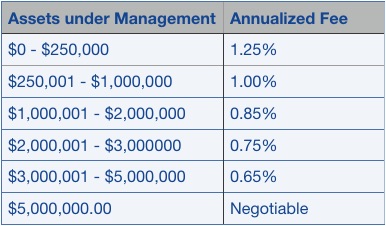

For example: An investor with a $200,000 portfolio would typically be charged an asset-based fee of 1.25%. If that investor averaged an 8% return over 30 years, s/he would have an ending balance of about $1.38M and would have paid about $240,000 in asset-based fees. Compared to our flat-fee model, the same investor would only pay $90,000 in fees and would have an account value of approximately $1.67M. That is almost $300,000 more for you to enjoy in retirement!

Your Complexity is Different than (Pre)Retirees

We believe there is more complexity in planning for your needs in retirement than in your accumulating wealth years. Think about all the life events which could have a major impact on your financial situation in your accumulating years.

- Getting Married

- Buying vs Renting

- Having Children

- Benchmarking Salary

- Negotiating Raises

- Building Credit

- Going Back to School

- Changing Careers

- Starting a Business

We definitely understand the allure of focusing on investments for our clients. While investments are certainly an important component to any successful financial plan, the other planning disciplines (estate planning, income tax planning, risk management, cash flow planning, employee benefits, and education planning), each play a crucial role in accomplishing your long term goals. This is why we evaluate every client holistically.

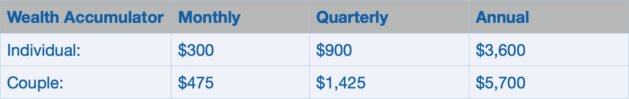

Our flat fee includes both Comprehensive Financial Planning and Investment Management Services. Once we decide to work together, there is a one-time client onboarding fee of $1,200 (individual) or $2,000 (couple) followed by an annual fee paid either monthly or quarterly.

Increased Complexity of Investment Management in Retirement

For clients nearing (or in) retirement, the amount and complexity of the work for an advisor increases when managing your portfolio. This is because in your accumulating years you have employment income to count on, but once retired, you will need to take some regular distributions from your investments to support your lifestyle.

As a (pre)retiree you have different planning needs:

- Safe Retirement Distribution Plan

- Social Security Maximization

- Possible ROTH IRA Conversions

- Tax Planning

- Estate Planning

- Medicare Review

- Death of a Spouse

- Philanthropy/Charitable Giving

- Required Minimum Distributions (RMD’s)

- Selling a Business

Consolidation of Assets

Consolidating your retirement accounts from various IRAs and 401-K is prudent in retirement. Consolidating your retirement accounts allows for more accurate asset allocation across your accounts, to reduce risk and help achieve your financial goals. There are also tax planning opportunities to help ensure you pay the least amount possible in taxes, while maximizing your income from the various accounts you may have (Qualified, Non-Qualified, Taxable, Tax Free, Tax Deferred, Pensions, Annuities, etc.).

Our asset-based fee includes both Comprehensive Financial Planning and Investment Management Services. Once we decide to work together, there is a one-time client onboarding fee of $1,200 (individual) or $2,000 (couple). Additionally, there is an annual percentage paid quarterly in arrears.

Our Services

Please click or hover over each service to learn more.

Wealth Accumulator

Perfect for clients serious about building wealth!-

Ongoing Comprehensive Planning

-

Follow-Up Meetings (Every 4-6 Months)

-

Ongoing Access to Planner via Email

-

Interactive Client Portal

-

Mobile App

-

Personal and Family Profile

-

Net Worth, Income, Savings, Expenses

-

Goals Analysis

-

Employment Benefit Review

-

Financial Position Statement

-

Liquidity Analysis

-

Cash Flow Planning

-

Debt Management

-

Student Loan Analysis

-

Investment Planning

-

Investment Policy Statement

-

Portfolio Management

-

Account Rebalancing

-

Tax Loss Harvesting

-

Asset Allocation

-

Investment Sector and Style

-

Investment Concentration

-

Investment Tax Allocation

-

Retirement Planning

-

Scenarios Impacting Assets, Taxes, Net Worth

-

Retirement Stress Test

-

Optimized Social Security Strategies

-

Medicare Analysis

-

Detailed Retirement Cash Flows

-

Insurance Analysis

-

Life Insurance Analysis

-

Disability Insurance Analysis

-

Long-Term Care Insurance Analysis

-

Property & Casualty Insurance Analysis

-

College Funding Analysis

-

Estate Checklist

-

Estate Analysis

-

Detailed Future Income Tax Return

-

Future 1040's

-

Future Schedule 1-4

-

Future Schedule A, B, D

-

Future Alternative Minimum Tax

-

Future Taxable Social Security

-

Tax Distribution Strategies

-

Roth IRA Conversion Analysis

-

Advisor Coordination

Wealth Preservation

Perfect for clients nearing or in retirement!-

Ongoing Comprehensive Planning

-

Follow-Up Meetings (Every 4-6 Months)

-

Ongoing Access to Planner via Email

-

Interactive Client Portal

-

Mobile App

-

Personal and Family Profile

-

Net Worth, Income, Savings, Expenses

-

Goals Analysis

-

Employment Benefit Review

-

Financial Position Statement

-

Liquidity Analysis

-

Cash Flow Planning

-

Debt Management

-

Student Loan Analysis

-

Investment Planning

-

Investment Policy Statement

-

Portfolio Management

-

Account Rebalancing

-

Tax Loss Harvesting

-

Asset Allocation

-

Investment Sector and Style

-

Investment Concentration

-

Investment Tax Allocation

-

Retirement Planning

-

Scenarios Impacting Assets, Taxes, Net Worth

-

Retirement Stress Test

-

Optimized Social Security Strategies

-

Medicare Analysis

-

Detailed Retirement Cash Flows

-

Insurance Analysis

-

Life Insurance Analysis

-

Disability Insurance Analysis

-

Long-Term Care Insurance Analysis

-

Property & Casualty Insurance Analysis

-

College Funding Analysis

-

Estate Checklist

-

Estate Analysis

-

Detailed Future Income Tax Return

-

Future 1040

-

Future Schedule 1-4

-

Future Schedule A, B, D

-

Future Alternative Minimum Tax

-

Future Taxable Social Security

-

Tax Distribution Strategies

-

Roth IRA Conversion Analysis

-

Advisor Coordination